Understanding Price Movements on PredictIt

What are price movements?

I’m talking about any time a price changes in PredictIt. You know, those little green and red arrows with an amount next to them.

Most often they’re a meager few cents, but sometimes they represent a huge swing, especially after a major event.

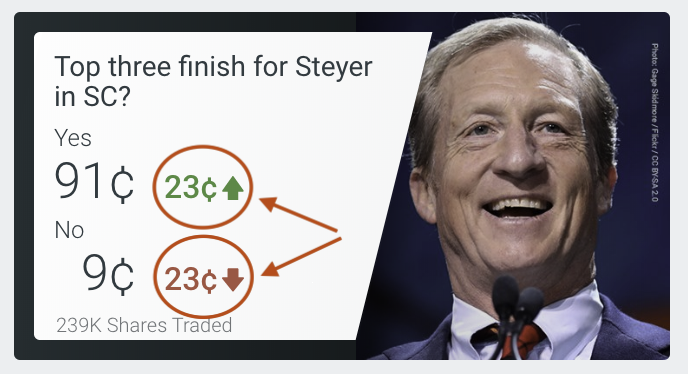

These indicators display the net change between a contract’s last stable price, and it’s most recent price. Remember, a contract and a market are two different, but related things.

In the Steyer example above, the arrows reflect changes in a single-contract market. It’s also very common to see multi-contract markets in which one contract’s price movements vary from that of the other contracts in the market.

So… what pushes these contract prices to change on PredictIt?

Well, remember that the price you see is the cost at which the most recent transaction– one trader purchasing shares from another– has taken place. More on trade dynamics here.

Such transactions depend on the highest price a trader is willing to pay for shares– and the lowest price another trader will sell them– at a given time.

Like economics, the prices offered in this supply and demand curve can depend on how traders react to various occurrences, such as a controversial tweet, or news of a high-profile political endorsement. For the remainder of this post, we’ll take a look at some of the most common of these occurrences to look out for.

Common factors that drive price movements

Here are some factors that can affect trader opinion, and thus drive price movement:

Political events

This is the most obvious one and can include election results, a bill passing the House, an executive order, a controversial quote on the campaign trail, etc.

Example:

Biden’s strong showing on Super Tuesday, and the unification of moderate Democratic candidates behind him, roughly doubled the price of his contract in the Democratic Nominee market from $0.40 to $0.80.

Non-political events

Yes this is intentionally broad, but can really be anything external to politics, not falling into one of the more specific categories below, that affects the market in which you’re betting.

Example:

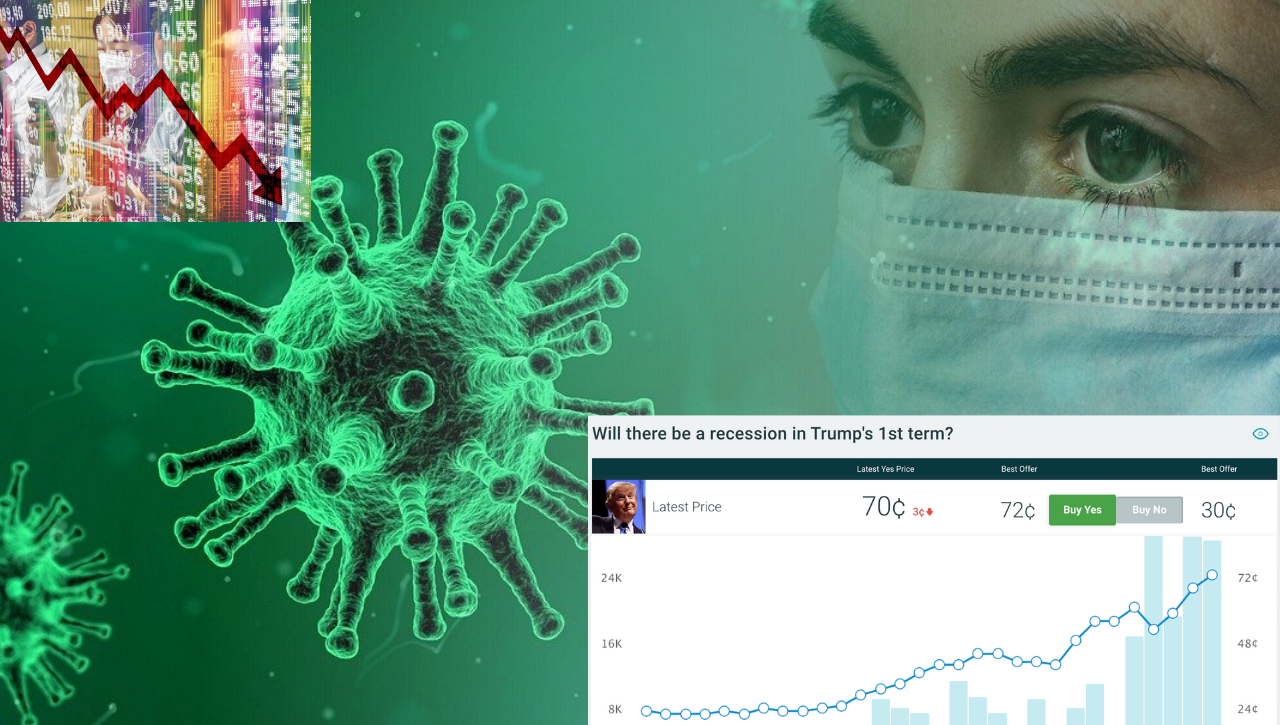

The coronavirus pandemic and subsequent stock market crash has bolstered the price of a Democrat victory in November past $0.50, and doubled the YES price of a recession during Trump’s first term from $0.35 to $0.70.

Public predictions made by professionals

Get to know the more frequent, successful PredictIt bettors; the best way to follow them is via Twitter.

Soon after they tweet a prediction, it is not uncommon to see a contract price shift as traders scramble to copy their position.

The magnitude of price change is correlated with that pro’s influence; pay attention to their Twitter follower count and how many people engage with their tweet(s).

Example:

When Rainbow Jeremy, probably the most influential pro, tweets his prediction for a market, the contract price often moves several cents higher accordingly.

Newly-released polls

Polls are usually the main price driver of election markets, but can influence others like presidential approval markets as well.

Majority of traders keep up with polls via RealClearPolitics and FiveThirtyEight. The polls listed on these sites are usually reputable, but always be sure to read them yourself.

Barring other factors, in election markets it’s common to see each candidate’s contract prices strongly correlated with the most recent election polling results.

Example:

The post Super Tuesday Washington primary market saw Bernie around $0.60 to win, and Biden at $0.40. Swayable released a new poll putting Biden at a two point lead in the state, and their prices swapped to Bernie: $0.40 and Biden: $0.60.

(It’s important to note this price swap was also accentuated by trader bullishness around Biden’s momentum after his recent Super Tuesday triumphs).

Viral news or claims

This can include news segments, public comments, or tweets, usually made by an influential person or entity on a topic related to the PredictIt market they affect.

The news does not necessarily need to be rooted in evidence; often it’s pure speculation.

Example:

Political commentator Matt Drudge announces, with no evidence, that 2020 democratic primary candidate Mike Bloomberg is adding Hillary Clinton as his VP. Clinton YES share price spiked 700% as a result.

Insider trading

Market manipulation (spoofing)

Anyhow, this list should be enough to give you an idea of what events affect trader opinion. Keep in mind these are not comprehensive; there can be endless factors influencing the price in a given market. My hope is by providing some of the most common ones, you can better identify them on your own.

Checklist to identify the factor behind a price swing

If I see a price has changed for a market, and I don’t know why, I do the following:

- Google keywords from the market to see if there are any breaking news headlines involving the topic

- Check to see if the pros have tweeted anything lately

- Check what news outlets, journalists, and political pundits are tweeting

- If it’s an election or approvals market, I’ll check fivethirtyeight.com or search google to see if any new polls have been released

- If all else fails, scroll through the recent comments under the market on PredictIt to see if other traders know what’s going on

A side note on comments: A PredictIt comment itself is rarely enough to move a market in any meaningful way.

Ignore the pumps; these are comments encouraging suckers to buy into a position that the commenter likely holds. The price rises as a result and the commenter dumps their shares for a profit soon after. Once in a while, among the pumps there will be a piece of real news. The key is just to make sure that you always verify any commenter’s claim on your own before believing it to be true.

Anyway, this is a quick checklist I use when trying to figure out why a market’s price has moved. Again, it’s not a comprehensive method, but just a reliable starting point.

Find out which price movements to capitalize on

Subscribe by email to the EdgeRaven newsletter, where I talk in detail about the markets that have caught my eye, and point out contracts with recent price swings that I think are worth taking advantage of. Always free, and emails are occasional, so no spamming your inbox.

Join the email list:

- March 16, 2020

1 thought on “Understanding Price Movements on PredictIt”

Pingback: How to Profit From Others' Mistakes on PredictIt - EdgeRaven