The Sure bets on predictIt (Playin' it safe)

[This article is part of a series, see Three Types of PredictIt Markets and How to Play Them]

How to spot sure-bet markets

I often identify sure bet contracts as having shares in the price range of $0.75-$0.90. These are usually very probable events whose price might otherwise be $0.90+ but stays lower due to a variety of factors, the most common of which being:

- The market not resolving for a while, so traders are unwilling to tie up their money long term because they think they can use that money to yield more profit trading other markets in the meantime

- Contrarian traders betting on the opposite outcome, often due to recent news or personal beliefs, hoping to catch a long shot payout

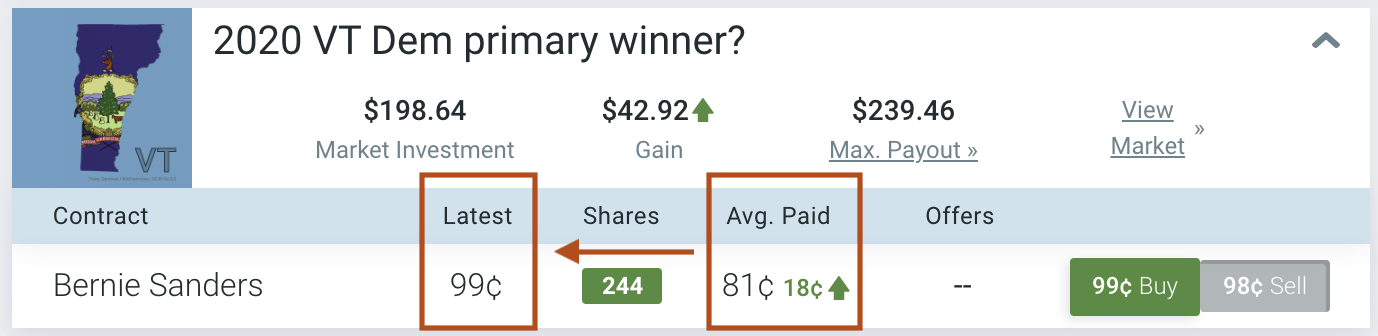

Back in November I took a YES position in the Bernie Sanders contract of the “2020 VT Dem primary winner” market. At the time, these shares were priced at $0.81. Given Sanders’ immense popularity in the Ben and Jerry’s motherland, I figured the only way this contract could fail is if he didn’t make it to the Vermont primary to begin with. However, with Vermont being one of the earlier primaries, and Bernie’s grassroots following, I could only foresee him dropping out before then due to unlikely factors such as health problems. As a result, I deemed this a sure bet and loaded up on shares. It is now a few days before the VT primaries and, sure enough, my share value has appreciated accordingly.

How to play sure-bet markets

I recommend playing these with the long term approach of buying shares with the intention of holding until the market resolves. If I have the funds available, I’ll try to max these out while I’m at it. Though stable, the returns are more meager than riskier contracts, so you want to be sure you’re getting as much value as you can here. Sometimes, if I’m a couple weeks/days from the market deadline and can sell my shares at $0.98 or $0.99, I’ll go that route and free up my cash early in exchange for a slightly smaller return.

If the market isn’t going to resolve for a while, I usually set my maximum threshold at $0.85 to enter a contract, meaning I won’t pay anything higher than that for shares. Sometimes, though, if the market is resolving in a relatively short period of time, say a month or less, I will pay for shares that are $0.90+ because it’s a quick way to get a decent return. A share price of $0.96 resolving in two weeks will return you 4% in that time; compare this with a savings account, which right now will yield you half that return over the course of a year. Which one would you take?

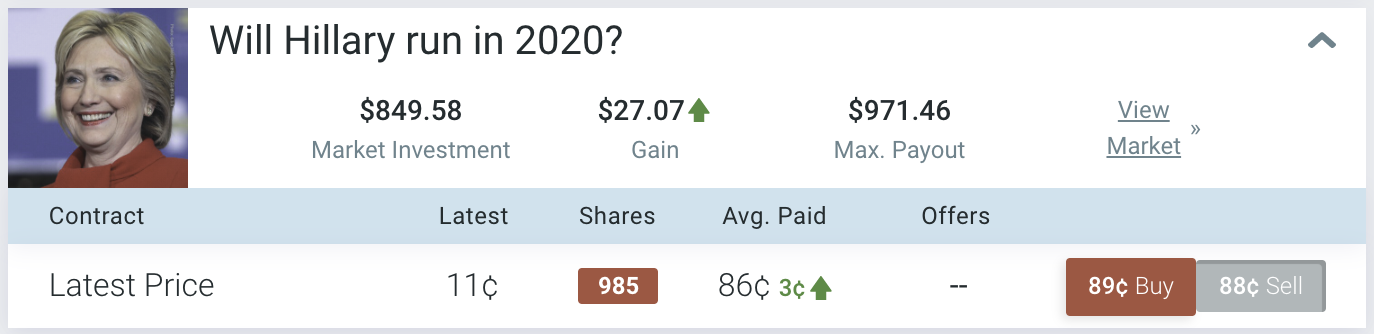

With all this being said, be careful because not every contract in a high price range is necessarily a sure bet. Traders love to overvalue contracts due to reasons like recent price momentum, current events/news, and personal political beliefs, among other factors. While somewhat rarer, I lump such situations in the “Swinger” category and find them to be lucrative opportunities, more so than the sure bets. From here, I recommend continuing by learning more about at Swinger Contracts or Long Shot Bets on PredictIt.

- February 29, 2020

4 thoughts on “The Sure Bets on PredictIt”

Pingback: Different Types of Contracts on PredictIt – EdgeRaven

Pingback: Long Shot Contracts on PredictIt – EdgeRaven

Pingback: Swinger Contracts on PredictIt – EdgeRaven

Pingback: Betting Your First Election - EdgeRaven