Swingin' It: 50/50 markets on predictIt

[This article is part of a series, see Three Types of PredictIt Markets and How to Play Them]

How to spot a swinger

Disclaimer: these have nothing to with that kind of swinger. Unless we want to make some kind of distant analogy about how these contracts are traded by many many people each day, then I guess we can draw that comparison. If you know, you know.

In theory, any contract can be a swinger, but I define these as contracts whose share prices for both YES and NO don’t usually go far below $0.40 or far above $0.60. Often, the price pair hovers pretty close to 50/50. Though I often use this as a quick way to start identifying them, swingers aren’t necessarily limited to this pricing criteria; I’ve seen contracts overpriced at $0.80 due for a predictable swing back down to $0.60, for instance.

A crucial component of a swinger contract is that it’s volatile enough to create the likelihood for substantial price changes in a relatively short period of time. These are some of my favorites because their volatility makes them perfect vehicles for taking advantage of these large swings in one direction or another, hence the name. Let’s look at an example:

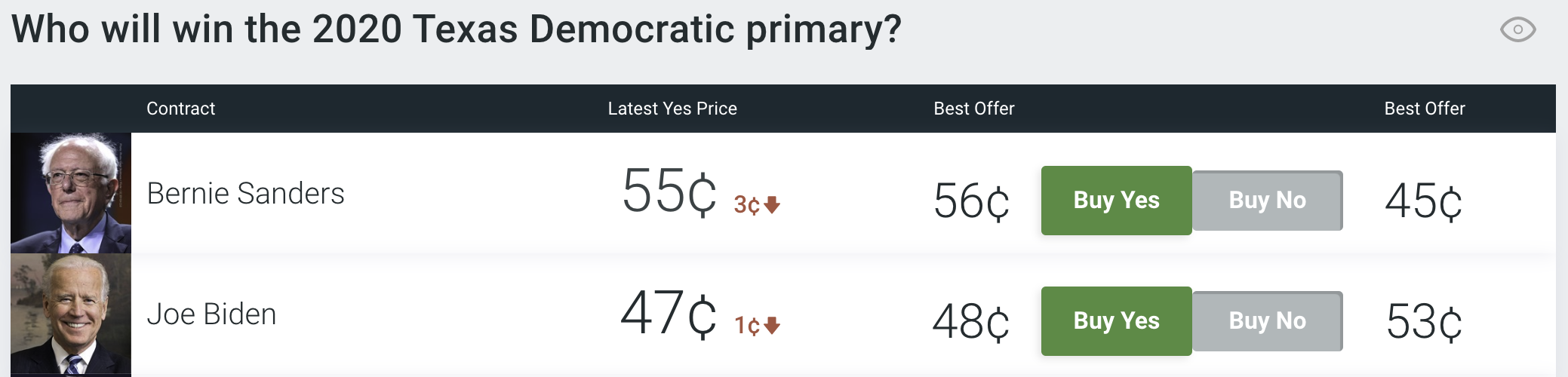

Bernie and Joe are both swinger contracts here. Not only because both of their YES/NO prices all fall within the 40c-60c range, but more importantly there is currently a lot of mixed opinion in this market. It’s currently one day before Super Tuesday and the Texas primary, meaning markets like these are bustling with trader volume and shifting in price by the minute. Reputable polls have been giving mixed results about who is more preferred in the state. Not only that, but a significant number of center-leaning democratic candidates like Pete Buttigieg and Amy Klobuchar have recently dropped out and endorsed Biden, knocking the Bernie contract here a few notches down from its previous spot around $0.70.

The best part? This is all happening extremely fast, in the wake of the recent SC primary results, turning many traders’ expectations on their heads. This type of mania and confusion is perfect for generating decent price swings in close-to-even markets like this one. Remember, humans are emotional creatures, and often don’t act rationally; PredictIt is no exception to this. However, if the outcome here is so uncertain, how does one profit in this situation?

How to play a swinger

Oh boy. These are some of my favorite markets, and usually my go-to during turbulent political seasons and high volume trade periods (like the 2020 Democratic Primaries going on now).

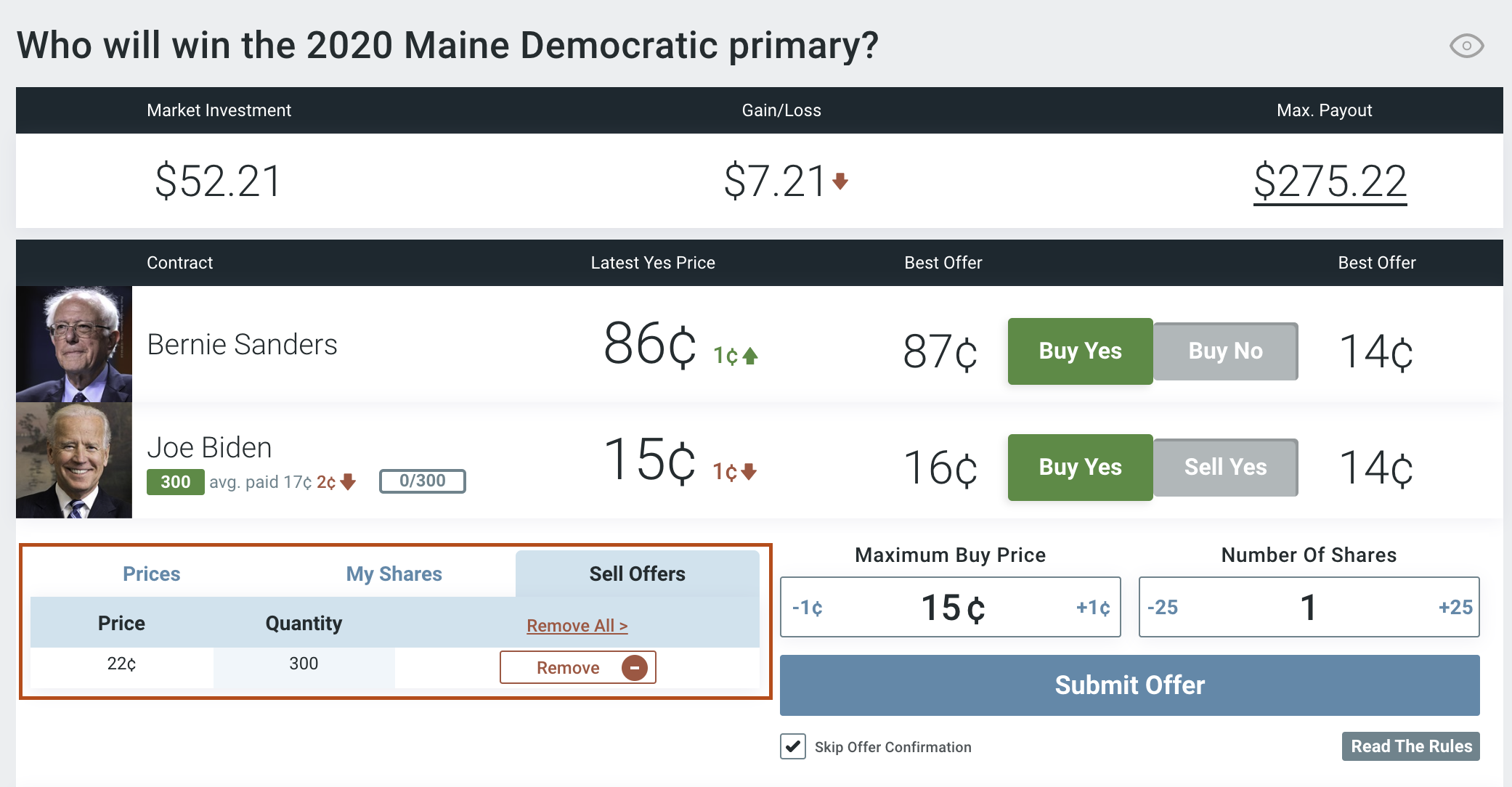

Since swingers can be uncertain, I don’t usually buy these with the intention of holding until market resolution. Instead, I try to buy into markets when I deem the share price to be undervalued, and then estimate the price to which I think they are likely to swing. This is usually referred to as an exit strategy. While we won’t get into details here, determining the correct exit strategy isn’t an exact science, an will often depend on understanding not only why you think the shares are currently undervalued, but what factors could drive the price up or down in the near future.

If you’ve read my article on buying and selling shares, you’ll know an exit can be set immediately after you purchase your shares by placing an offer for the price at which you want to sell them. Then, should the swing occur and demand for your shares become available at your offer price, PredictIt will automatically fill your order and place the money in your account.

It’s important to note that exit strategy isn’t a concept unique to swinger markets only; it can, and should, be applied to any market you’re invested in, including the sure bets and even more so the long shots. In my opinion, the riskier the bet, the more effort you should put into perfecting your exit strategy. This is a nuanced concept on its own, and one to which I will probably devote an entire article in the near future, so stay posted.

For now, I suggest continuing on to Long Shot Contracts, or Sure Bets, if you haven’t already.

Enjoying this content?

- March 02, 2020

6 thoughts on “Swinger Contracts on PredictIt”

Pingback: Long Shot Contracts on PredictIt – EdgeRaven

Pingback: Different Types of Contracts on PredictIt – EdgeRaven

Hello I am Poyo the soft cat. I would like to introduce you to our new Prediction Market social discord: https://discord.gg/AzkZB44

Hello Poyo- I actually joined the discord this week! Username is Kalog. You were the one who welcomed me in 🙂

Pingback: The Sure Bets on PredictIt – EdgeRaven

Pingback: How to Profit From Others' Mistakes on PredictIt - EdgeRaven