How to Profit From Others' Mistakes on PredictIt

Where one gambler fucks up, another will profit

Circle of life, principle of equilibrium, survival of the fittest; call it what you will, this fact is just as prevalent in political markets as it is in mother nature.

No matter how good of a trader you are, there is no magic formula to avoiding mistakes 100% of the time.

But recognizing when other traders have made an error– and capitalizing on it– will always be a fundamental tenet to any successful betting strategy.

Other traders dictate market pricing

PredictIt’s convenient pricing structure means we can map a contract’s price to the percentage probability of its outcome coming true.

If Joe Biden’s price in the Democratic Nominee market is 75 cents, you could say he has a 75% chance of winning the nomination, or a 25% chance of losing it. That’s straightforward enough.

We already know share prices depend on how much a trader will purchase or sell them for, which, in turn, is driven by their confidence level in the event’s outcome.

In simpler terms: all prices on PredictIt represent trader-determined probabilities.

This means the current price of a contract represents the likelihood it comes true according to the people trading in the market at the current time.

And, in case you didn’t already get the hint by now, these traders aren’t always right. In fact…

Most traders suck at determining probability

And you can’t blame them.

Even the most seasoned traders can rarely, if ever, perfectly calculate an event’s inherent, right-on-the-dot probability of coming true, because determining an event’s exact odds is damn near impossible.

In fact, if we had a magical crystal ball to which we could ask “What is the probability of Trump winning Florida in November?” we would likely receive a figure that’s changing every second, much like the numbers on the betting board display in a Las Vegas sportsbook.

Estimating an event’s inherent odds as closely as possible is the hardest part of betting. Figure out a system to do it well, and you’ve found yourself a golden ticket to success.

It might come as no surprise, then, why so many bettors are way off the mark when it comes to accurate predictions.

This can be due to a combination of different factors, not limited to: a lack of sufficient research, pre-existing political leanings, emotional betting, or trader sentiments at a given point in time, all of which affect price movements.

While it’s the most important factor separating the stellar bettors from the mediocre ones, a reliable system of determining probabilities is useless without an equally robust system of applying them.

How you figure out this probability is up to you. It’s the secret sauce, unique to each bettor and different for each market.

On the other hand, once you’ve estimated an event’s probability with confidence, the principles of using it to extract as much money as possible tend to be very consistent. Let’s take a look.

Exploiting discrepancies in pricing

PredictIt has just released a new market, and we think we have what it takes to crack it. Let’s assume we’ve put in some research, checked our models, and come away with a pretty good probability estimate of our contract hitting.

How do we profit from this information? First, we determine if other traders in this market are wrong. If so, we exploit their mistakes.

If we are confident in the accuracy of our estimate, we can compare it to the market price and easily identify whether this price has deviated enough from our estimate to pose a lucrative opportunity.

Remember: on PredictIt, a contract’s price represents the probability that other traders believe an event will come true, with no guarantee of accuracy.

Sometimes, shares will be underpriced, with prices way below our own estimate. Other times they can be overpriced, or way above.

Either way, it doesn’t matter. If underpriced, then you can scoop up some YES shares a bargain price. If overpriced, it’s better to do the opposite, as the expensive YES shares could mean the NO shares are, instead, the bargain here.

Both underpriced and overpriced shares are what constitute inefficient markets. Inefficient markets are simply those whose prices do not accurately represent an event’s true odds of occurring. And they are chock full of trader mistakes, where few manage to value the outcome as accurately as you have.

An efficient market, on the other hand, is priced closely to the true likelihood the event comes true. Traders in these markets tend to be on top of their game, hence why nobody’s leaving underpriced shares on the table, or overpaying for them.

We can find plenty of both markets every day on PredictIt. But at the end of the day, we are looking to put more of our money into inefficient markets, and less into efficient ones.

The greater the inefficiency– in other words, the greater the difference between the current market price and the true probability of the event– the more other traders are fucking up, and the bigger our profit opportunity.

Nevada: an example

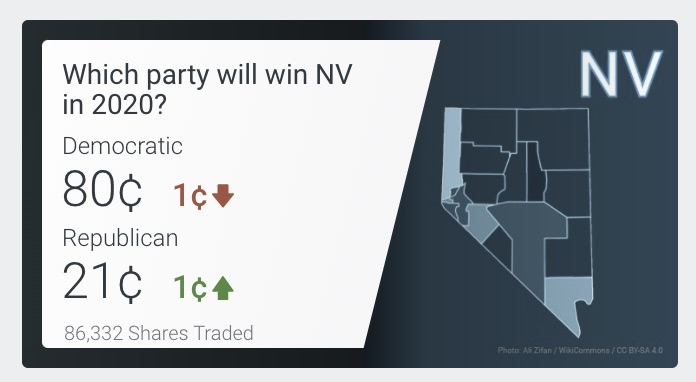

There’s a lot of value theory going on here, so let’s walk through it with a practical example. Take the Nevada 2020 market:

We see hundreds of other traders have decided to value the likelihood of a Republican victory at 21%. But let’s assume we’ve done our homework and are certain those chances should be closer to 40%.

In this case, the 21 cent Republican YES shares are way underpriced– about half of what they’re really worth– and a great bargain, so we’ll invest in some. And since there are only two contracts in this market, let’s also not forget the Democratic YES shares are overpriced here.

We won’t invest in those, but we know Democratic NO shares must be priced similarly as Republican YES. Since the market considers these both as the same outcome, the Democratic NO shares are then also underpriced at ~20 cents. We can scoop some up to bolster our position if, say, we run out of Republican YES shares to buy at a bargain price.

This is exactly the type of (hypothetically) inefficient market in which we’d want to park our cash.

Some final thoughts

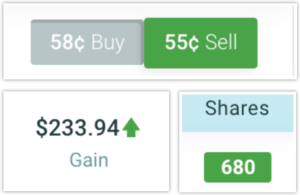

To recap, the next step after estimating an event’s inherent probability is to identify whether there is inefficient pricing around its contract. If so, we know other traders are making mistakes, so we subsequently take a position at a bargain entry point (buy price).

Underpriced shares aren’t always available at any given moment. If you believe the market is volatile enough that they may become available, like in swinger contracts, you can place a buy order and wait for PredictIt to automatically purchase those shares on your behalf.

Determining an exit point– the price at which to sell these shares– is a different challenge altogether.

Bettors whose strategies call for higher-frequency trades may simply wait for the contract price to correct itself– in other words, for inefficient markets to become efficient– and then dump their shares at the “true” price, pocketing a nice gain.

Other times, it may be preferable to hold your shares till market completion to optimize your expected value.

Expected value is a core tenet of my bankroll-building strategy on PredictIt, and one that I learned during my days playing poker and betting on sports. Personally, I consider it the most fundamental cornerstone of any successful betting approach.

To read more about working the theory presented in this article into an expected value betting approach, check out Seeking Value on PredictIt

2 thoughts on “How to Profit From Others’ Mistakes on PredictIt”

Pingback: Expected Value (+EV) on PredictIt - EdgeRaven

Pingback: Betting Your First Election - EdgeRaven