Betting Your First Election

Some perspectives on election betting with PredictIt, to help you place smarter wagers in 2020 and beyond.

Let’s say we have a pretty good hunch about which candidate will win the Democratic nomination for the upcoming 2020 election.

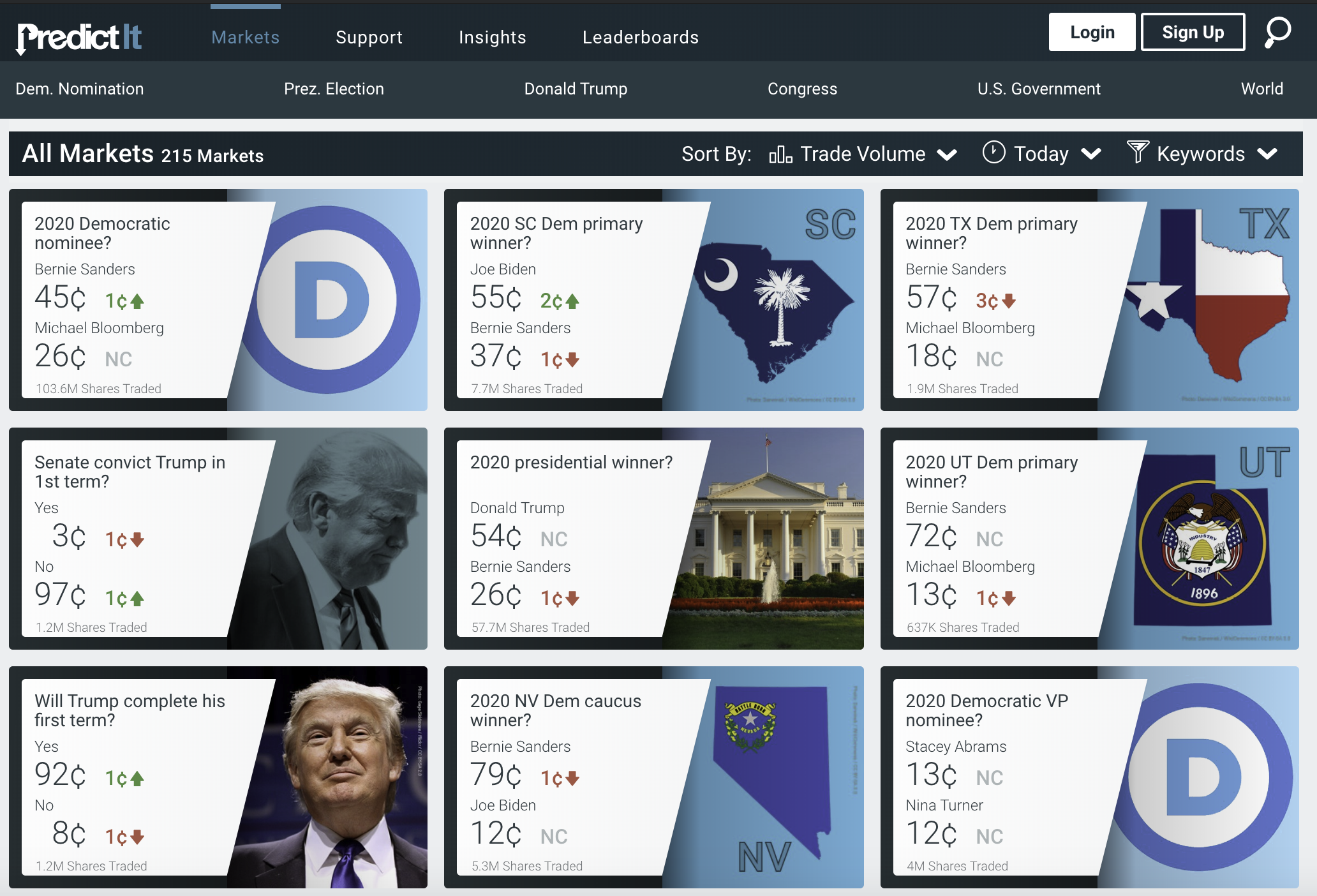

We might decide to bet on the “2020 Democratic nominee?” market, which also happens to have the highest trade volume right now. Here is what we see:

There are several different betting options here on who we think will win the nomination: Bernie, Bloomberg, Biden, Buttigieg (whoa, lotta B’s) and so on.

Each of these rows is known as a contract. A contract defines a binary, yes-or-no answer to the question posed in the market.

You can buy shares in YES if you think the contract will correctly answer the market’s question.

Likewise, you can purchase NO shares, if you think a different contract will be correct. This is especially convenient if you are certain, say, that Bloomberg will not be the nominee, but are not sure who actually will be.

Some markets, like this one, are known as multi-contract markets because they consist of many different possible answers.

There are also single-contract markets which, you guessed it, are made up of only one such option.

You can purchase either YES or NO shares in a given contract, but never both at the same time, in the same contract.

In a multi-contract market, you can bet on multiple contracts at once.

This allows you to hedge or add complexity your bets; say, if you’re certain the primary winner will be one of Bernie or Bloomberg, but are not sure which, you can buy YES in both contracts.

You are also allowed to buy YES shares in one contract and NO shares in another, because it’s not the same contract.

Contract prices will always fall between $0.00 and $1.00; the price you see listed represents that of one share in the contract.

If the outcome you are betting comes true– that is, if the contract in which you hold YES or NO shares correctly answers the question posed by the market– each share you own will be redeemed by PredictIt at $1 each.

Likewise, if your share position does not correctly predict the market outcome, the value of each incorrect share you own plummets to zero, and you will lose that investment, when the market resolves.

It is possible, though rare, for multiple contracts to come true; the opposite case, where no contract ends up correct, is possible as well, and usually more likely.

In these cases, PredictIt often includes a clause to resolve the uncertainty. For example, in a market with political candidates, we may see a tiebreaker defaulting to the individual with the earliest alphabetical last name.

Each market comes with a set of rules defining how PredictIt plans to determine a winning contract.

These will often try and be as specific as possible, namely to avoid confusion and anger from traders in ambiguous or unprecedented situations.

While, for the most part, this is a good practice, sometimes it results in certain clauses that can have significant impact into how the market is priced, and how it gets resolved.

For this reason, you should always read and understand the rules before putting your money into any market.

Never assume the name of a market accurately describes or covers how the market will get resolved, because most of the time, it doesn’t tell the whole story.

Let’s look at an example:

These are the rules from a single-contract market called Will Trump’s next Supreme Court nominee be a woman?

Take a moment to read the highlighted clause stating the conditions under which this market resolves to a NO.

On first read of the market name, you may be inclined to imagine a NO shares being paid out if Trump nominates a male judge.

However, given this clause, a NO outcome really encompasses all of the following:

If you skipped over the rules and instead assumed your shares would be refunded should Trump not nominate any judge, you’re gauging your risk in the market incorrectly, and in greater danger of losing your investment.

As you can see, one clause in the rules can force you to consider numerous different factors and ultimately should change the way anyone approaches betting in this market.

Now that you understand markets, you’re ready to take the next step: Buying & Selling Shares in PredictIt

Some perspectives on election betting with PredictIt, to help you place smarter wagers in 2020 and beyond.

You don’t need to predict each market correctly every time to earn money on PredictIt. Learn how to use expected value (EV) to return a consistent profit over time.

Learn how to identify discrepancies in odds in order to take advantage of shares that have been underpriced by other traders.