Betting Your First Election

Some perspectives on election betting with PredictIt, to help you place smarter wagers in 2020 and beyond.

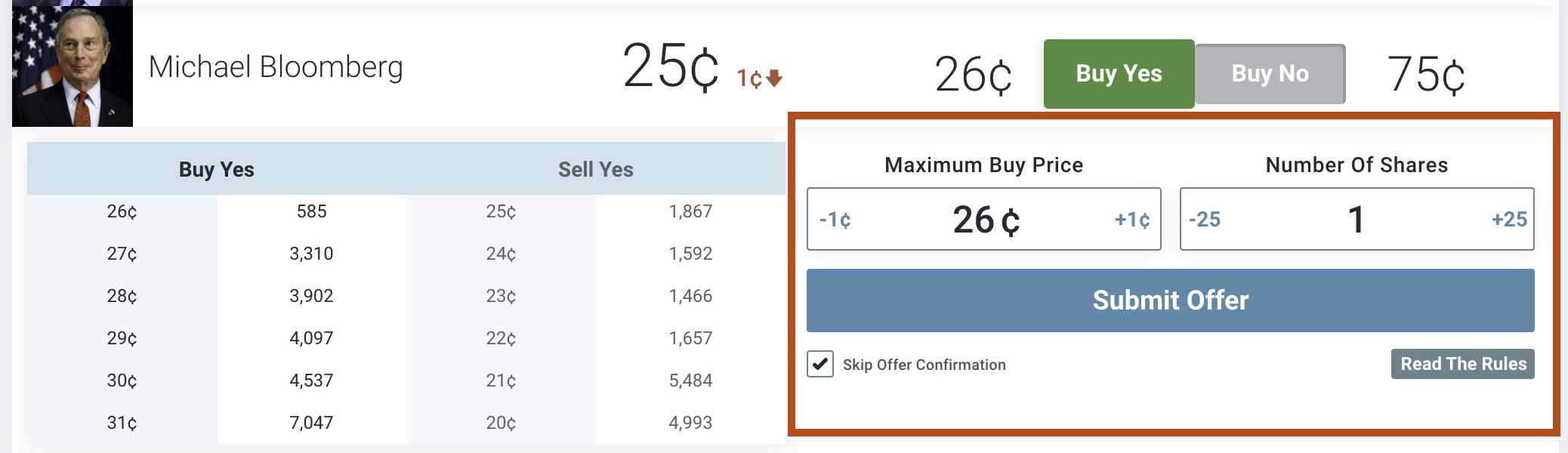

Okay, say we are looking at the “2020 Democratic Nominee?” market, and the Bloomberg contract has piqued our interest. We decide to buy some shares, so we click the green “Buy Yes” button. The contract drops down to reveal an interface underneath containing menus of existing buy/sell share offers, along with a widget to submit your own.

Take a look at the “Buy Yes” menu below, outlined in red. Inside it, we see a column of share prices on the left, and a column with the number of shares corresponding to that price, on the right. Let’s break these down in more detail.

What if there aren’t enough shares available for sale at the price you want? If you’re okay paying a bit more, you can increase your maximum price. PredictIt will still scoop up the cheapest shares for you first, but you are giving it permission to pay higher, if necessary, to accumulate the total number of shares you want.

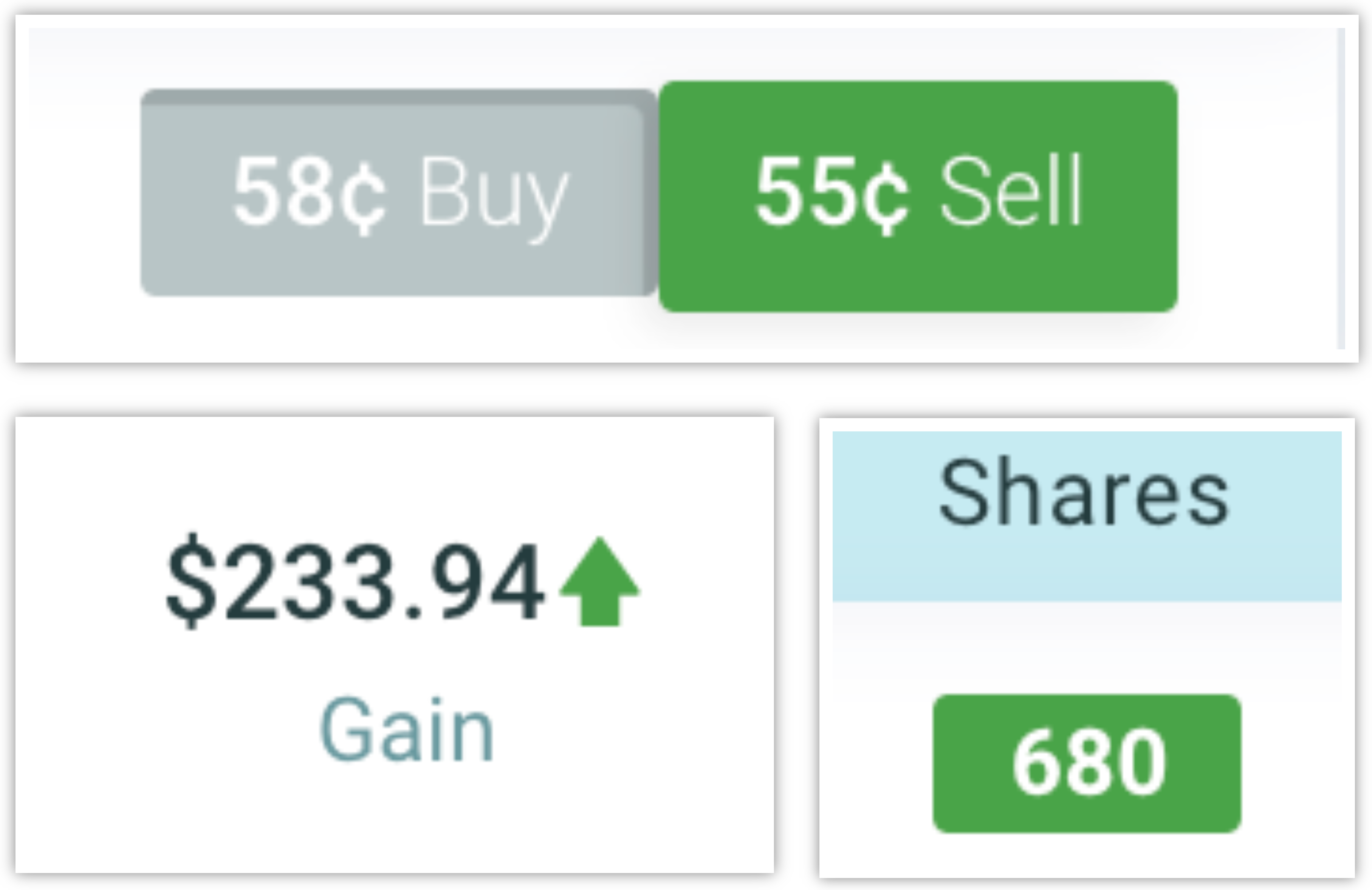

In the example above, I want to purchase 700 shares of Bloomberg YES at $0.26, but see there are only 585 available right now. I decide to set my maximum buy price to $0.27, and submit the offer. PredictIt purchases all available 585 shares at $0.26 for me, plus the additional 115 shares at $0.27, adding up to my desired total of 700. In this case, I sacrifice a cheaper price for the benefit of purchasing my shares instantly.

On the other hand, if you know you’d like to buy shares at a lower price available, you can submit an open offer at that price. While you may have to wait some time, your order gets filled automatically if the market dips and shares become available at that price point. Even if you’re away from your computer at that moment. Stock traders may recognize this to be the same concept as a buy limit order.

With open offers, you carry the risk of the order not filling should shares never become available at the price you want. However, it allows you to pounce if they do become available at the price you want, and it happens automatically without requiring your immediate presence. Sometimes, only part of your desired share amount might get auto-purchased at a time; in this case PredictIt will still maintain your open order to purchase the remaining shares at the same price, unless you tell it otherwise.

Now that you understand the mechanics of buying shares, you’ll be glad to know the process of selling them operates in a similar, but reversed manner. You will notice the “Buy No” button from before has been replaced with a “Sell Yes” button; this is because you cannot own both a “Buy Yes” and “Buy No” position in the same contract. Since I already own YES shares here, there is no longer a need for “Buy No.”

Right now, I own 80 shares of YES in the market “Will Tom Steyer finish in the top three in the South Carolina primary?” Clicking on the green “Sell Yes” button shows us a similar interface as before.

We see our price and share columns again, but under the red outlined “Sell Yes” menu. This time, the prices decrease top to bottom, from $0.63 to $0.60 and less. Each row in these columns again represents an accumulation of open orders from other traders, but in this case these are from people looking to buy shares at that price. As the seller, the top price ($0.63) represents the highest amount you can currently liquidate your shares for.

Remember, the columns tell you how many shares are available for trade immediately, and at what price. If you decide you can get more for your shares than what the open orders are currently willing to pay, you again have the option to place a sell offer at a specified Minimum Sell Price.

The Minimum Sell Price denotes the cheapest price you are willing to let your shares sell for, and operates in the same way as the Maximum Buy Price in that PredictIt will try to get you the most money for your shares by filling the higher-price orders first. This is– you guessed it– analogous to a sell limit order.

These entries are essentially what constitute each market. Share availability, purchase, and sale are what drive and set the prices for each contract. The Buy and Sell prices below, highlighted in magenta and gold, respectively, indicate the most desirable price currently available at each position (i.e. whether you’re looking to buy or sell). The overall contract price, highlighted in red, is updated with the average price of the most recent share transaction, in real time.

There are many different strategies for share trading on PredictIt. It’s common for traders to buy shares and immediately list them for sale at a much higher price, usually what they think the shares will actually be worth. If they’re correct and someone eventually places an order at that price, the shares liquidate automatically and the seller pockets the profit without having to lift a finger. Some people load up on ultra-cheap $0.01 shares of an event that’s highly unlikely to come true, in hopes that some media story or other hype will be enough to drive the price a meager one-cent higher. It doesn’t seem like much, but hey, that’s a100% return on your investment right there. Whatever the strategy, I look forward to covering it in more detail, here on EdgeRaven.

Sign up for the official EdgeRaven newsletter for exclusive commentary on which markets I am currently invested in or considering, and a detailed breakdown of my thought-process behind it. Whether you trust my insights or simply use them as a starting point for your own research is up to you. Completely free, and there’s no catch.

Some perspectives on election betting with PredictIt, to help you place smarter wagers in 2020 and beyond.

You don’t need to predict each market correctly every time to earn money on PredictIt. Learn how to use expected value (EV) to return a consistent profit over time.

Learn how to identify discrepancies in odds in order to take advantage of shares that have been underpriced by other traders.