Sniping those multipliers: long shot contracts on predictIt

[This article is part of a series, see Three Types of PredictIt Markets and How to Play Them]

Spotting a long shotter

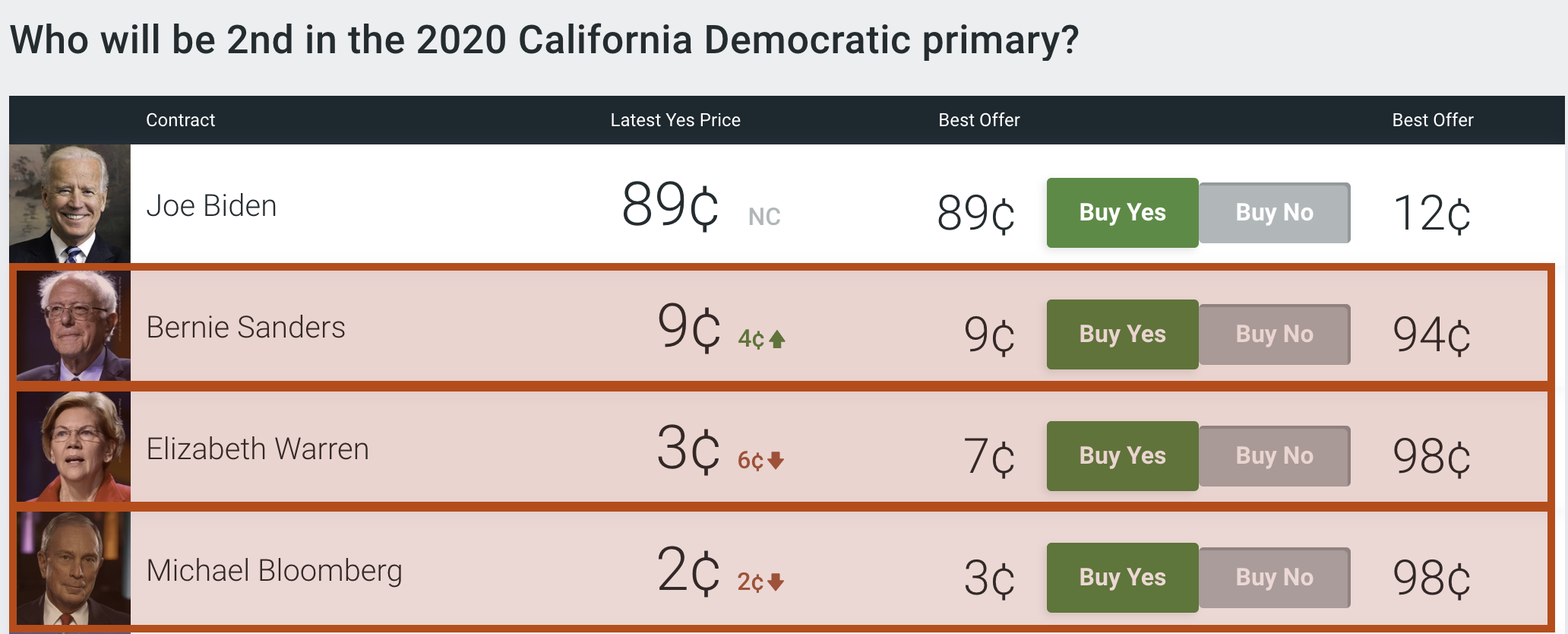

These are the contracts that will inevitably make you think am I just throwing my money away? as you ponder buying. They’re the contracts with insanely cheap share prices, in the neighborhood of $0.01, $0.05, or maybe somewhere in between $0.10 – $0.20. And for good reason: these represent events that are very very unlikely to actually come true. Check out the three highlighted markets:

You can see by the depressing sequence of $0.09, $0.03, and $0.02 prices that most traders have pretty much made up their minds that Bernie, Liz, and Mike will not place second in California. If I had to guess, I would agree with them. But if that’s really the case, why is Bernie still at $0.09, for instance? Wouldn’t his contract value just collapse entirely to $0.01, the cheapest possible price? It may confuse you even more to see that there are hundreds, sometimes thousands of open orders placed by people trying to load up on contracts just like this.

As insane as these traders seem for wanting to throw their money at things that seemingly will never happen, you’ll be surprised to hear sometimes there’s good reason for doing so– even if they’ll still never happen.

Playing the long shotters

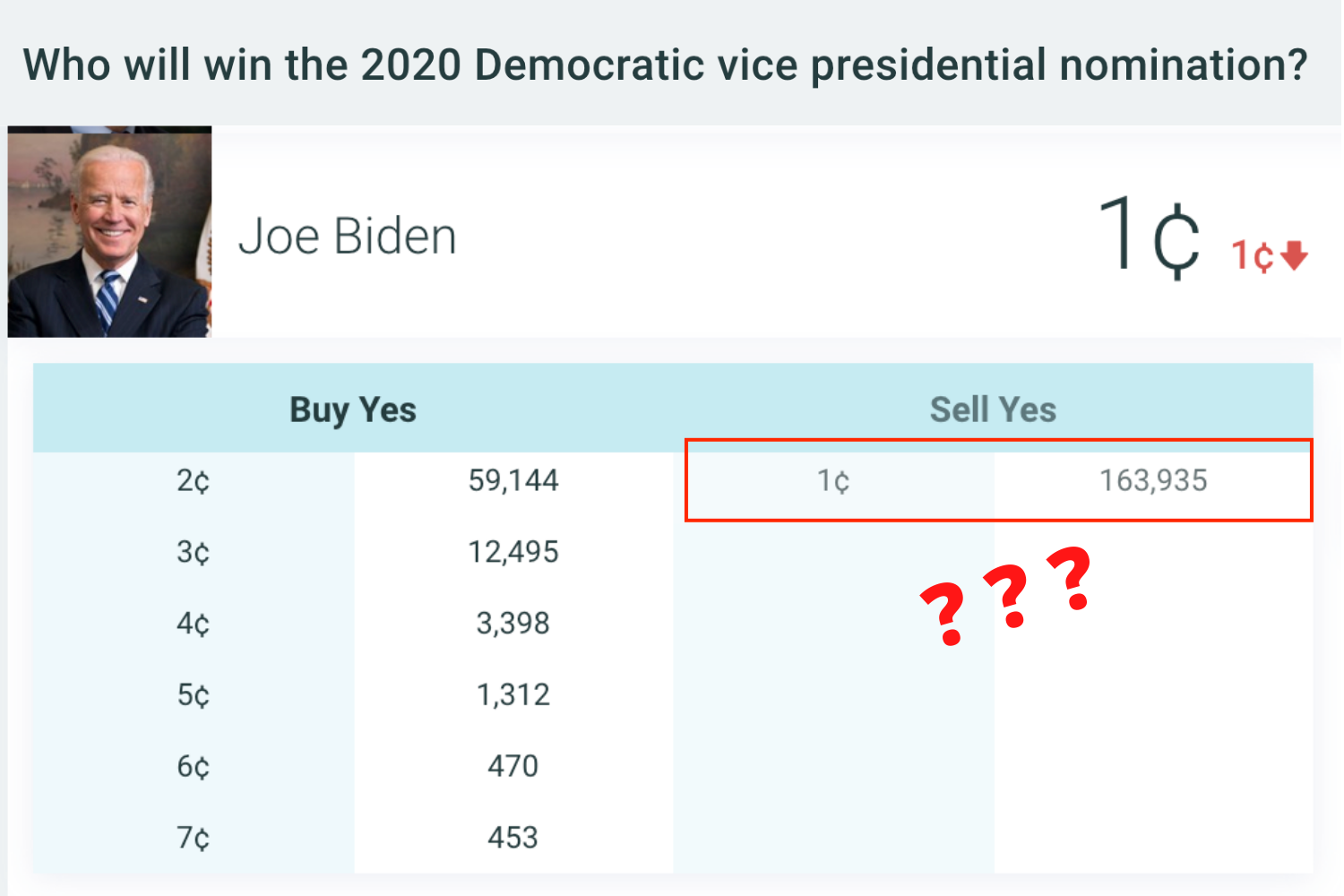

People still tend to trade long shots because they can sometimes be incredibly lucrative. For example, if you invest in $0.01 shares Biden becoming VP and it comes true, you’ve just made back 100 times your investment. If you invest in Bernie placing second in the CA primaries at $0.09, and he does, you’ll take home over 1100% your initial investment, which is still a phenomenal return.

To be fair, drastic wins like these are extremely rare, so don’t get too optimistic, though they do happen from time to time. However, you can still profit handsomely off cheap shares even if you don’t think the contract will come true in a million years. All you need to do is accurately predict when other traders’ opinions will drive up prices by a comfortable multiplier. Since long shot contract shares are so cheap initially, it’s very common for some new development, even as simple as a speculative article, to multiply the share price 2x, 4x, even 20x. So don’t ignore the cheapies just because others are. Here’s a great example:

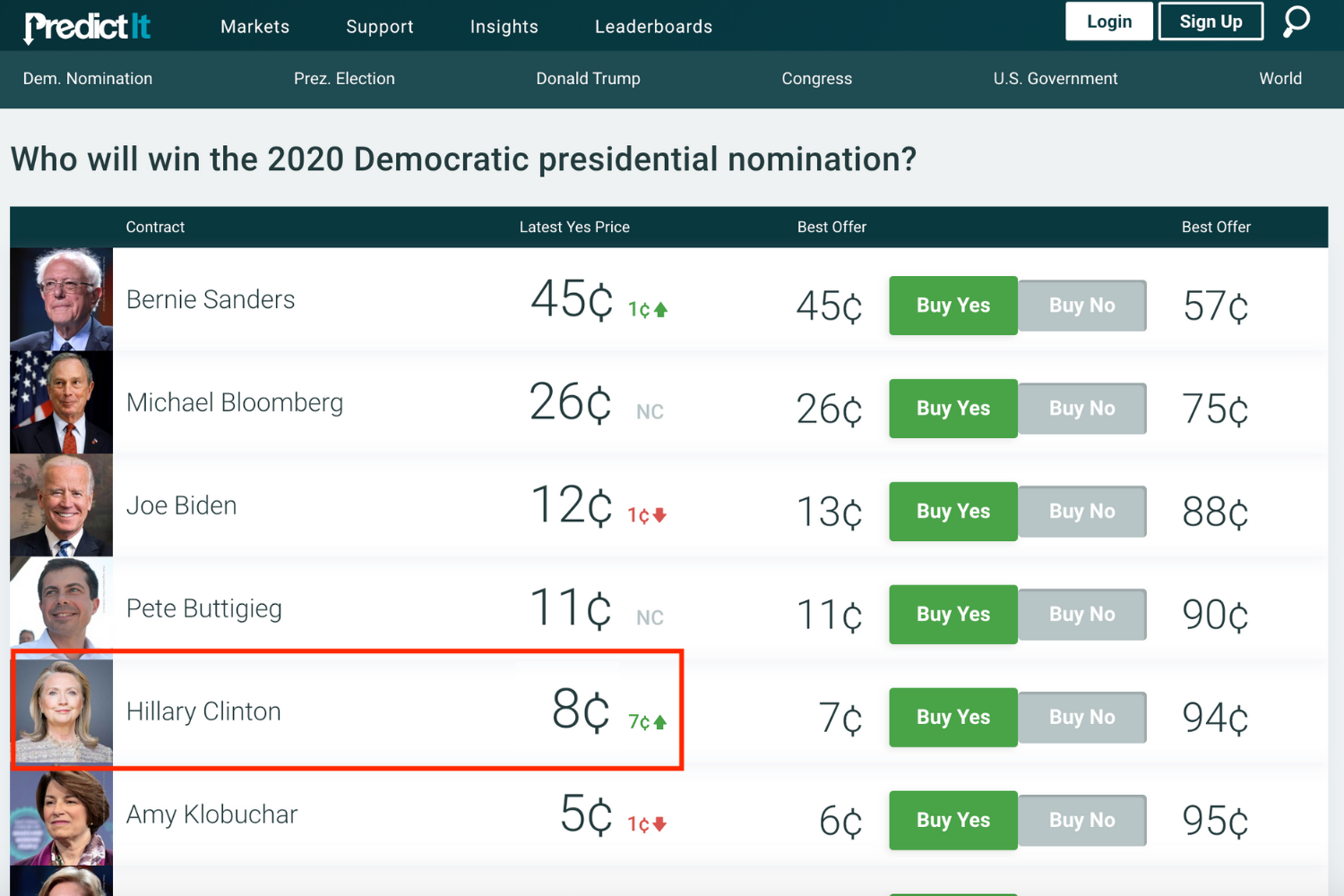

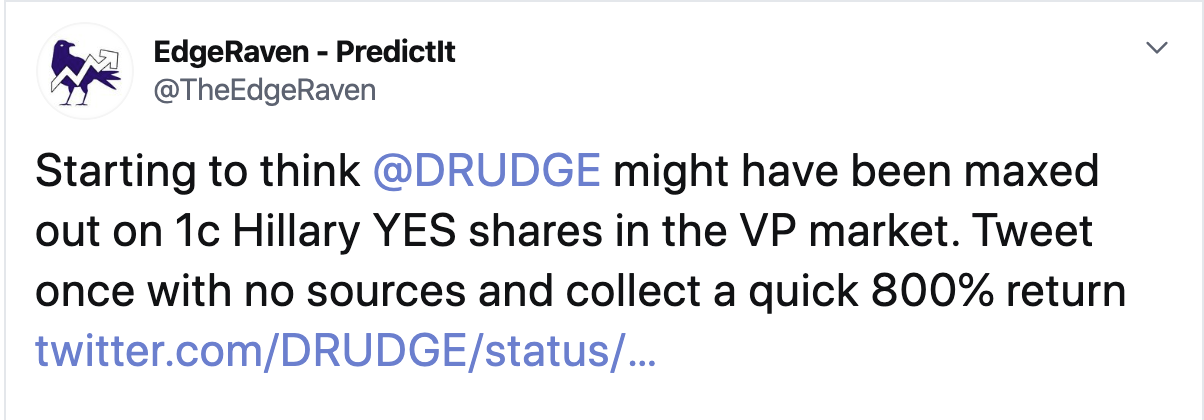

This happened when a sketchy-sounding Drudge Report announcement claimed, out of the blue, that Bloomberg was priming Hillary Clinton to be his VP nominee in the 2020 race. Clinton’s contract in the 2020 Democratic presidential nomination market responded by shooting up from $0.01 to $0.08. And yes, you read that image right. This is the presidential nomination market responding to the news, despite Drudge’s claim that Clinton would only run as VP. It didn’t matter, traders still ate it up.

Did Drudge have any reliable evidence to back up his claim? Not really. Was this likely a hot take designed to generate media attention and traffic to his website? I like to think so. Too bad it didn’t matter. Traders holding $0.01 Clinton YES shares before the announcement saw a 700% return on their investment. A 7-cent increase might seem like pennies, but it adds up. If these same traders happened to have maxed out their positions with an $850 investment, their principal would have grown to $5100!

Predicting a surge like this isn’t easy, and aside from having a natural intuition for political moves there is usually no reliable way to do it every time. That’s why a common way of playing these markets is to invest a small amount of money in a lot of different contracts, hoping at least one will hit. In our Clinton example, a trader could lose his or her same principal amount seven times over and still break even overall.

As one professional bettor put it: Every morning, instead of wasting my money on Starbucks, I sweep the 1c offers. Such is the world of long shotting on PredictIt.

I assume by now you’ve already read about sure bets and swinger contracts, but if not, be sure to check those out. Otherwise, I hope this has been a useful guide to more easily approaching the three most common types of contracts on PredictIt. With that being said, it’s important to note that these categories aren’t ever hard-and-fast. Things move at a rapid pace on PredictIt, so at the end of the day, just use your best judgement. Happy trading!

Ready to dabble in different markets?

Sign up for the official EdgeRaven newsletter for exclusive commentary on which markets I am currently invested in or considering, and a detailed breakdown of my thought-process behind it. Whether you trust my insights or simply use them as a starting point for your own research is up to you. Completely free, and there’s no catch.

Join the email list:

- March 02, 2020

4 thoughts on “Long Shot Contracts on PredictIt”

Pingback: The Sure Bets on PredictIt – EdgeRaven

Pingback: Different Types of Contracts on PredictIt – EdgeRaven

Pingback: Swinger Contracts on PredictIt – EdgeRaven

Pingback: Understanding Price Movements on PredictIt - EdgeRaven