Expected Value (+EV) on PredictIt

Value-seeking vs. prognosticating

When you think of a seasoned PredictIt trader, you probably imagine a savant wagering on markets whose outcome they feel they can correctly predict.

This outcome-based strategy is probably the most common way to play the markets. If I think Trump will win Texas, for example, I’ll bet on that outcome. I call this the progosticator approach– simple and straightforward.

While many traders are incredibly successful with this approach alone, it isn’t the only road to profit. Enter expected value.

Expected value, or EV, is a fundamental statistical concept and cornerstone of many betting strategies, across everything from sports betting, horse racing, and poker, to political gambling and more.

Instead of wagering on a market based purely on the expectation of predicting its outcome, finding positive expected value (+EV) entails seeking out attractive, bargain share prices, even when we’re not sure how the market itself will resolve.

This makes up what I call the value-seeking approach, which is reliant on the concept EV. Buckle up, we’re gonna do some math.

Calculating expected value

Expected value for one bet is simply the following:

For any given PredictIt contract, this formula must consider the probabilities of both YES and NO taking place.

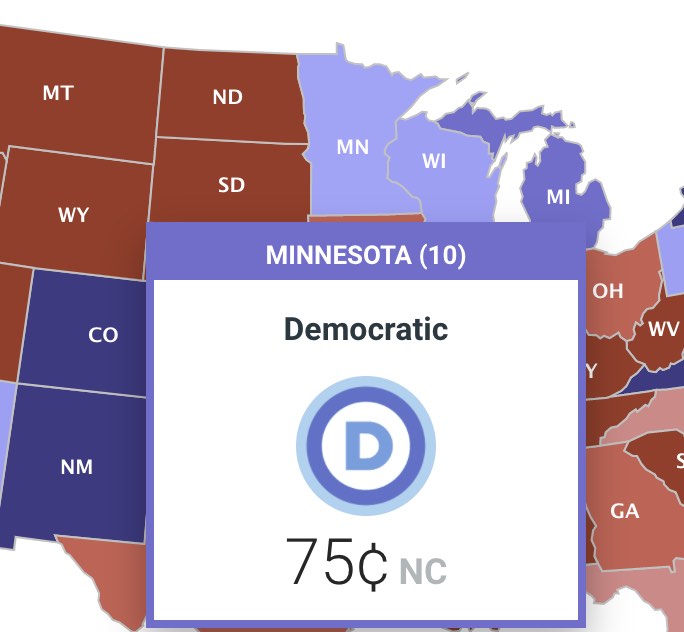

Say we’re planning to purchase $10 worth of YES shares, priced at 25c each, for a 2020 Republican victory in Minnesota.

$10 / $0.25 gives us 40 shares, meaning our payout will be $40 ($1 per share) if a Republican wins Minnesota. This would net us a profit of $30, which is our $40 payout minus our initial $10 investment (I am ignoring PredictIt fees for simplicity).

Since $10 is our initial wager, this is how much we will lose should a Republican fail to take the state. The 25c share pricing gives this bet a 25% probability of winning; likewise, the probability of losing, then, is 75%. Now we have all our variables:

- Probability the bet wins: 25%

- Money we stand to profit: $30

- Probability the bet loses: 75%

- Money we stand to lose: $10

We plug these into our equation: EV = (.25 x $30) – (.75 x $10) = $0

Our expected value here is zero. You may be wondering why.

Well, I made one large assumption that the share pricing offered by this market is directly representative of the true, inherent odds of a Republican victory in Minnesota. In other words, I assumed this market was efficient.

This leads us to a key point: by buying shares that are efficiently priced, we will only break even over the long run. For this reason, we can only find +EV if we predicate our value-seeking strategy on placing money into inefficient markets.

If you haven’t already, I highly suggest reading more about inefficient markets here before going any further.

Minnesota again, but with inefficient pricing

Now let’s take our same example, but this time with an inefficient market.

Keep in mind, inefficiently-priced shares mean they deviate from the true odds. As such, they can be either underpriced or overpriced.

We will still assume the true odds of a Republican victory are 25%, but now we will say that PredictIt is pricing this outcome five cents cheaper at 20c, which offers 20% odds.

Since these odds are 5% less than the true odds of 25%, the shares are now underpriced, and there’s potential for +EV.

Let’s reassess our numbers in this exercise. $10 is still our wager amount, and still the amount we stand to lose. Remember also that the inherent probability of this bet winning is still 25%.

However, due to the cheaper pricing, $10 / .20 allows us to buy 50 shares– a potential payout of $50. This time, the new payout minus our $10 investment would earn us a slightly higher profit of $40.

If we recalculate, we see our EV = (.25 * $40) – (.75 * $10) = $2.50

In other words, if we were to make this same bet many times over the long run, we would take home a profit of $2.50 each time, on average.

The reason we now see a positive EV is because we took advantage of the inefficiently priced shares.

Despite true odds of 25%, we paid only 20c for these shares, which is a huge bargain allowing us to profit.

Likewise, we must be careful not to overpay for shares, which can have the opposite effect and leave us with -EV.

Value-seeking is a long game

The key to making profit is seeking out underpriced shares in inefficient markets, again and again over time.

In fact, time is the real difference maker here. Expected value only truly gets realized after enough bets are made over a long enough period of time to minimize luck and variance.

In order to come away with +EV in the long run, we must, again, keep in mind the distinction between inherent odds of a bet coming true versus the odds we are being offered (and willing to take) on that bet.

Remember that other traders determine a market’s price on PredictIt, where each price offers its own built-in odds: 25c is offering 25% odds, 79c is offering 79% odds, et cetera. When we decide to buy shares at that price, we are taking the odds offered by the market.

When market odds are equal to the true odds, we break even in the long run

If the market offers us odds that accurately reflect the true odds of the event happening, we stand to only break even by taking them.

This is equivalent to buying efficiently-priced shares, and is a neutral bet over time.

For example, say we bet on a market outcome with inherent odds of 60%. We’ll win this bet 60% and lose 40% of the time.

Now, assume the market is also offering us shares in this outcome at 60c; a price reflecting the inherent odds. If our bet wins, our shares will get redeemed at $1, earning a per-share profit of 40c.

Our per-share EV is (.60 x $0.40) – (.40 * $0.60) = $0/share.

Though we may win or lose some money in the short run due to statistical variance, making this bet over and over will eventually cancel itself out.

When market odds are longer than the true odds, we have +EV in the long run

Likewise, if the odds offered by the market are longer (less likely) than the true odds of the event, taking them is a +EV move.

This is equivalent to buying underpriced shares, and is a good bet long term.

For example, if the market offers us 60c shares on an event that inherently has a 72% chance of taking place, we’ll win this bet 72% of the time, and lose it 28% of the time. Our potential profit is still 40c/share.

Our per-share EV is positive: (.72 x $0.40) – (.28 x $0.60) = $0.12/share.

Though we don’t expect to win this bet every time, the profit from the times we do will overshadow the losses from the times we don’t.

When market odds are shorter than the true odds, we have -EV in the long run

Lastly, if the market is offering us shorter (more likely) odds than the true probability of the event coming true, this is considered a -EV play.

This is equivalent to buying overpriced shares, and is a bad bet long term.

For example, if the market offers us 60c shares on an event that inherently has a 55% chance to happen, we’ll win this bet 55% and lose it 45% of the time. Again, our potential profit is 40c/share and loss is 60c/share.

Taking this wager has an EV of (.55 x $0.40) – (.45 x $0.60) = – $0.05/share. Notice this is negative.

When buying overpriced shares, we will lose more of our investment on losses over time than we’ll regain from our comparatively smaller payouts when we do win.

+EV bets vs. predictive bets: two different mindsets

I described earlier the purely prognostigative strategy, which involves wagering on select markets where we think we can predict the immediate outcome.

This is an entirely different mindset of picking wagers compared to value-seeking, where we don’t care about predicting a market correctly every time. Instead, we only care whether the market’s share price/odds offer us +EV.

One way to visualize the difference: a 5c PredictIt contract offers 5% odds, which are unlikely enough that we seem justified in thinking there’s no reason to bet on this market.

However, if we determine this outcome actually has an inherent 10% likelihood, we’ll opt to wager on it from a value-seeking standpoint despite the fact that there’s still a 90% chance it will lose.

Over the long term, we will win this bet just once for every nine times we lose it. However, that one win will pay out 20x our initial stake, while we spend only 9x that on the losses surrounding it.

The idea here is that the 10% of wins we’ll eventually hit offer a large enough payout to overcompensate for our losses from the 90% of times we miss.

Foregoing the instant gratification of trying to guess every market outcome correctly, in favor of sometimes putting down money on seemingly unlikely events, can be an incredibly counterintuitive process at first.

Such contracts probably won’t pay us off the first few instances, but after focusing on betting them enough times, and maintaining our faith in statistics, this strategy will eventually turn a profit.

Thus, we can see not only why +EV requires patience as a long term strategy, but also tons of discipline. And discipline shall be handsomely rewarded.

Conclusions and caveats

The value-seeking strategy outlined thus far assumes that once we bet on an event, our money is locked in till the outcome is resolved.

This is generally the case in sports betting, for example, where you can wake up in the morning and place a bet on a game that same night. The quicker pace means a sports bettor’s money is rarely tied up in one place for long.

This is not true for PredictIt, where markets tend to stay open for a months, or even years at a time.

The flip side, though, is that you are not doomed to wait until the outcome of a market to see whether you’ve made money or lost your entire investment.

It is possible to dip out of a position early when you have new information about a souring bet, or if you think the price has reached most of its potential. This market dynamic separates PI from other forms of betting, and there exist many ways to capitalize on it.

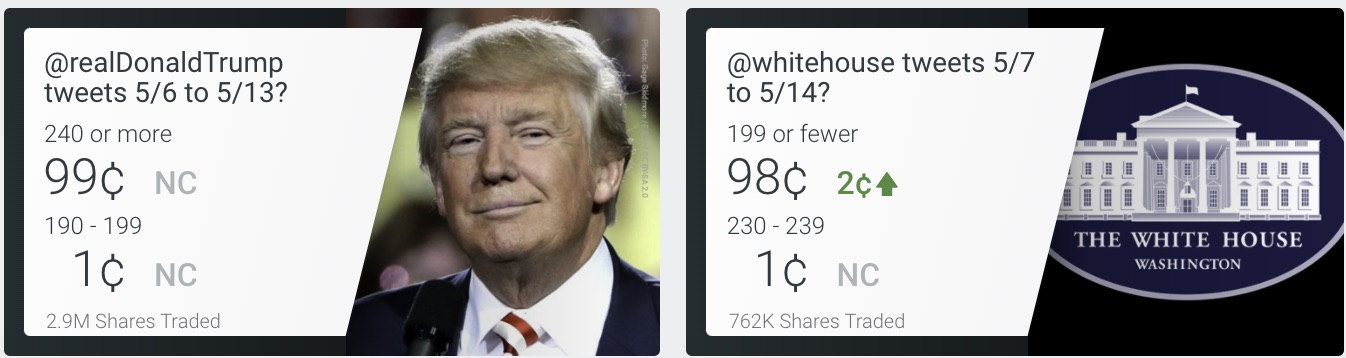

Let’s not forget a key exception to this dynamic, however. Tweet markets pay out shares after exactly one week – a considerably quick timeframe on PredictIt– then a new market comes out for the next week, and so on.

Tweet markets are ideal for bettors who prefer holding their investments till market resolution, providing more frequent opportunities to seek out statistical value, and on a more consistent basis. Give ’em a try, if you haven’t already.

One more thing– it’s important to keep in mind that not everyone on Predictit always applies a purely value-seeking strategy. Some traders are simply very good at the prognostigative approach of predicting outcomes, while most employ a hybrid of both.

In the end, we all have the same goal: to make as much money as possible. This is simply one tried-and-true method to help you in that pursuit.

Want to see value-seeking in action?

Sign up for the EdgeRaven newsletter for exclusive insight into how I approach new markets with expected value in mind, and identifying value shares in statistically profitable markets. Emails are sent out occasionally– no spam– and it’s always free.

2 thoughts on “Expected Value (+EV) on PredictIt”

Pingback: How to Profit From Others' Mistakes on PredictIt - EdgeRaven

Pingback: Betting Your First Election - EdgeRaven